san antonio tax rate 2021

Southside - 3505 Pleasanton Rd. The property tax rate for the City of San Antonio consists of two components.

Did South Dakota v.

. 2021 low income housing tax creditchodo apartment capitalization rates according to house bill 3546. For questions regarding your tax statement contact the Bexar County Tax. The San Antonio sales tax rate is.

The County sales tax rate is. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. The Texas sales tax rate is currently.

The san antonio texas sales tax is 825 consisting of 625 texas state sales tax and 200 san antonio local sales taxesthe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. Northeast - 3370 Nacogdoches Rd. The current total local sales tax rate in San Antonio TX is 8250.

Tax Rates The Official Tax Rate Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction. The San Antonio Texas sales tax is 625 the same as the Texas state sales tax. This is the total of state county and city sales tax.

San Antonio ISD 15023 Somerset ISD 13223 South San Antonio ISDHarlandale ISD 13912. The minimum combined 2022 sales tax rate for San Antonio Texas is. What is the sales tax rate in San Antonio Texas.

48 rows Find the local property tax rates for San Antonio area cities towns school districts and Texas counties. View photos map tax nearby homes for sale home values school info. Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

There is no applicable county tax. Northwest - 8407 Bandera Rd. City of San Antonio 0558270 City.

39 rows 2021 Official Tax Rates Exemptions. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. RATES PROPERTY TAX GREATER AUSTIN SAN ANTONIO 2021.

The FY 2022 Debt Service tax. To avoid an election the city would have no choice but to reduce the citys portion of the property tax rate. Medina County Precinct 2 Special Road Tax 00500 Potranco Acres Public Improvement District 05000.

No Tax Knowledge Needed. The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. Jessica Phelps San Antonio Express-News.

4835 Usaa Blvd is a property in San Antonio TX 78240. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and. County officials project a 19 percent increase in revenue because of a tax on new properties and an increase in property valuation throughout Bexar County said Leni Kirkman the University Hospital Systems vice president of strategic. Answer Simple Questions About Your Life And We Do The Rest.

3000 1325 state fee 1150 local fee 5475. San Antonio collects the maximum legal local sales tax. What is San Antonio property tax.

Greg Abbott signed the new law Senate Bill 2 in 2019 and it took effect in 2021 when the citys property tax revenues. The tax rate varies from year to year depending on the countys needs. Maintenance Operations MO and Debt Service.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. The December 2020 total local sales tax rate was also 8250. This is the total of state county and city sales tax rates.

The minimum combined 2021 sales tax rate for san antonio texas is. While many other states allow counties and other localities to collect a local option sales tax Texas does not permit local sales taxes to be collected. After a contentious debate Bexar County Commissioners on Tuesday approved a 28 billion budget and a reduction in the county tax rate that will shave a.

Homestead tax exemptions 100 disabled veterans pay no property tax in the state of Texas. The rates may vary according to the weight. Adopted Tax Rate per 100 valuation General Operations MO 09502.

For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. File With Confidence Today. The 825 sales tax rate in san antonio consists of 625 texas state sales tax 125 san antonio tax and 075 special tax.

5182021 41718 PM. The 2021 rate of 276237 cents per valuation is mostly unchanged from 2020s rate of 277429 cents per 100 valuation. Tax Rate 100.

The Best Places To Retire In 2021

New Mexico Income Tax Calculator Smartasset

The Best Places To Retire In 2021

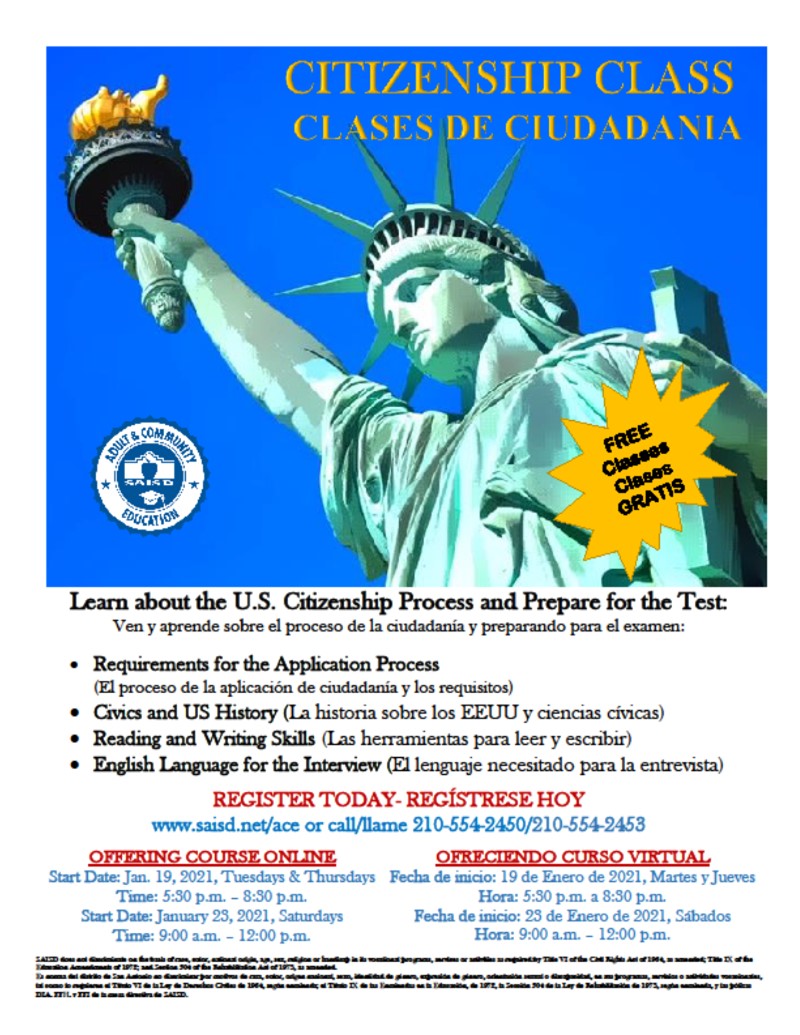

Adult Community Education Saisd

City Year San Antonio City Year

Property Tax Exemptions Senior Disabled Texas

New 2021 Harley Davidson Fat Boy 114 Motorcycles In San Antonio Tx Deadwood Green

New 2021 Harley Davidson Fat Boy 114 Motorcycles In San Antonio Tx Deadwood Green

Adult Community Education Saisd

Moving Expenses Now Taxable For Department Of Defense Civilian Employees Contractors Joint Base San Antonio News

Adult Community Education Saisd

Property Tax Exemptions Senior Disabled Texas

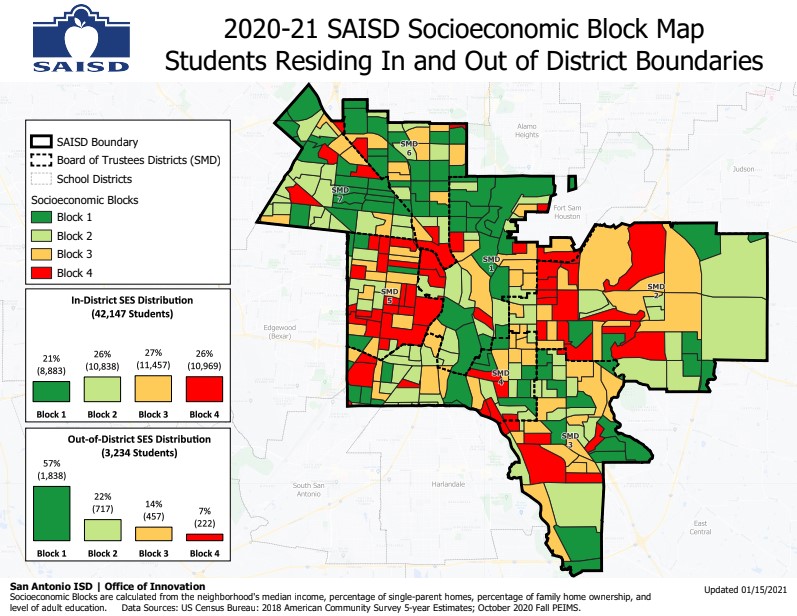

Socioeconomic Blocks Office Of Innovation

Adult Community Education Saisd

Socioeconomic Blocks Office Of Innovation

2022 2027 Bond Program Election Called For May 7 2022 The City Of San Antonio Official City Website